Albert Einstein once said that compound interest is the eighth wonder of the world, and we at Denver Private Wealth Management agree. Understanding the power of compound interest is one of the most important keys to setting yourself up for financial success.

Here’s an example. Imagine rolling a snowball down a mountain: while the snowball may start off small, it will continue to grow bigger and bigger as it rolls down the slope. By the time it reaches the base of the mountain it will be gigantic! Compound interest works like that snowball. As you save money in an investable account, the market will roll that fist–full of snow down the mountain for you.

Let’s look at how this might play out in the real world.

Assume you’ve set up your investable assets to chase an aggressive 8% annualized return. If you start with $1,000, you can expect to make $80 that year. That may not seem like a huge difference for a year’s worth of investing, but the power of compound interest is that next year, you’ll be starting with $1,080. Assuming another 8% return, you’ll end your second year with $1,166.40. The year after that? $1259.71, and so on and so forth. The larger the dollar amount, the stronger compound interest works. Take a look at what an 8% return can do over five years on $500,000.

As you can see, the scalable power of compound interest can make all the difference in setting you and your family up for financial independence.

Time Horizons

There’s an old story that Ben Franklin bequeathed the equivalent of $100,000 to Philadelphia and to Boston on his deathbed, under the condition that the money largely remain untouched for 200 years. By the late 20th century, that money had compounded enough to create the beloved Franklin Institute Museum dedicated to science in Philadelphia and the technical college in Boston called the Benjamin Franklin Institute of Technology aimed at providing higher education for engineers and technology professions. None of this would have been possible without Ben Franklin’s long-term vision and understanding of compound interest.

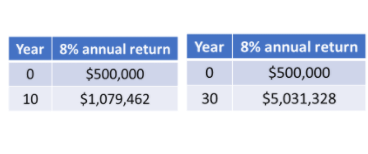

This story is a great illustration of the importance of time. Without two centuries of compound interest, the museum in Philadelphia and college in Boston he bequeathed never could have happened. The same principle applies to your investments. The more and — this is key — the earlier that you can start investing, the more work compound interest will be able to do for you. Take a look at the following charts that explain the difference a few years can make. Assuming the same $500,000 nest egg, imagine having 10 years until retirement vs. having 30 years before you need to touch the money.

Conclusion

Compound interest is a fundamental law of finance. It’s an incredibly powerful tool that you can use to secure the future that you dream of. But to fully harness that power — to drop the snowball from the top of the mountain, rather than halfway down the slope — you’ll need to invest as much as you can as early as you can. You’ve already worked hard, saved money, and have begun the process of learning more about your finances. We at Denver Private Wealth Management can help you supercharge your wealth.

Denver Private Wealth Management is an independent fee-based financial planning practice with 80+ years of experience in the financial industry. DPWM customizes portfolios based on your financial goals and works closely with you, your tax advisors and estate attorneys to form a comprehensive view of your financial situation. For more information or to set up a free consultation, contact us at info@denverpwm.com.

Post Disclaimer

The information contained in this post is for general information purposes only. The information is provided by The Power of Compounding Interest and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

Drew Kelleher, CFP®

Drew Kelleher, CFP®

Tim Kulick, CPA®

Tim Kulick, CPA®

Trackbacks/Pingbacks