Now that we understand the diversification value that private investments can bring to your portfolio and what each asset class aims to achieve, let’s take a deeper dive into the darling of the private investment asset classes: private equity.

Private equity allows companies to find investors outside of public equity, otherwise known as stock ownership from the general public. In private equity transactions, funds and investors invest directly into the company in the form of venture capital or buyouts. First, let’s explore buyout funds.

Buyout Funds

Buyout funds seek out undervalued or underperforming companies in which to purchase a controlling interest in order to grow their profitability and eventually sell or take public. Think of it like flipping a fixer upper in the real estate market. The acquisitions of these companies are usually done with a combination of cash and leverage (loans). In current market conditions, mortgage and loan rates are in a low cycle. Buyout funds take advantage of this low interest rate environment and use loans to acquire these companies, intending to position themselves for success.

Since 2000, the net asset value of buyout funds has grown 3.5x[1] the value of public equity as illustrated in the graph below (as of 2018).

Why is this? As seen in the next graph, private companies have been trading notably cheaper than their public counterparts, providing greater profit potential than the U.S. public stock exchange.

While valuations remain low in private markets and more money flows into buyout funds, there is a concern: If the investing advantage in private markets is centered around a size premium of sourcing and investing in deals deemed “too small” for Wall Street, then what happens to the returns of buyout funds as private equity continues to mature?

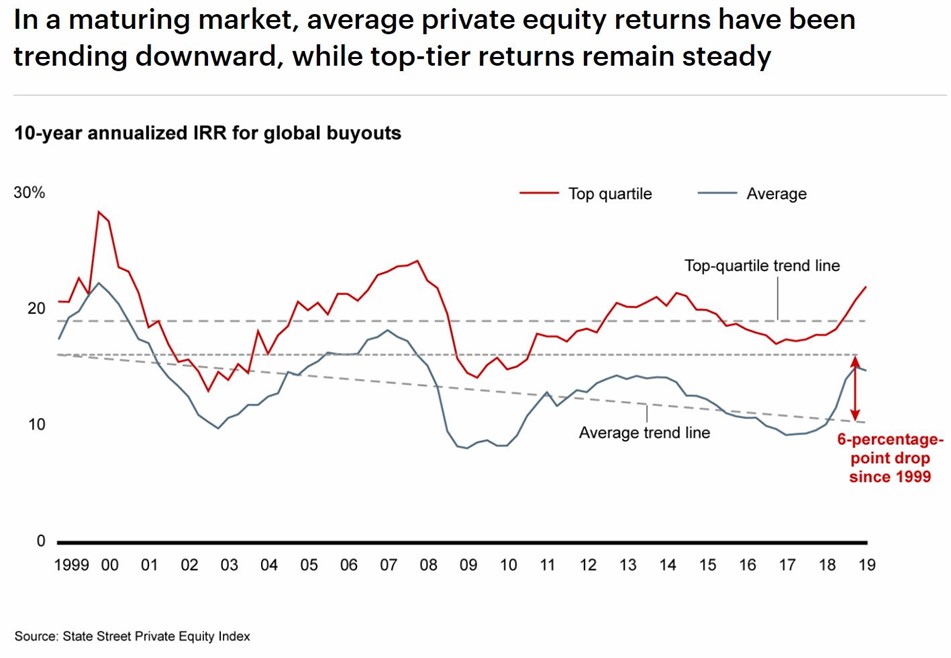

The chart below, showing the slow decline of private market returns over the last 5-10 years, addresses this concern and confirms that a maturing private market will make it more difficult to find inefficiencies to take advantage of as more and more money and players flow into the space.

Even with a slow decline, it’s worth noting that the top 25% of buyout managers have maintained steady returns compared to the rest of the industry. As the market matures, established players are using their size and economies of scale to solidify their position in the private market pecking order.

Venture Capital

The other way to participate in the private equity world is to invest in a company very early in their lifecycle – another way of saying that an investor will provide capital for someone else’s new venture. Due to their focus on future appreciation, venture capital investments typically have very long hold periods with many years of negative cash flow. The ultimate goal in the venture capital world is to find and invest in future “unicorns,” or private companies worth at least $1 billion.

Because the investment is made in a typically unprofitable and unproven company, venture capital is seen as very risky. And with increasing money flowing into the private markets creating more access to capital for startups, hold periods are increasing as companies wait longer to go public. A study done by a University of Florida professor named Jay Ritter found that in 1999 the average life of a technology company to go public was just four years; in 2019 the average life of a company going public is now 11 years[1].

Even with the outsized risk, venture capital continues to gain in popularity as it is linked to many tech-backed startups for the outsized returns it creates. Imagine being an early investor in Airbnb or Uber and it’s easy to understand that the potential for profit is hard to ignore. However, as the below chart shows, the “unicorns” used to be a lot more elusive:

Venture capital had paltry returns in the first half of the 2000’s. As the tech bubble formed, venture capitalists helped propel undervalued tech companies in which other investors weren’t interested. The famously strong returns of the last ten years pushed venture capital to the forefront of the private investment world. While it may be the riskiest of all the private asset classes, it also carries with it the largest potential returns. But as with buyout funds, a maturing market means more money and more competition for investors. The biggest players with the best access to deal flow tend to stay on top as shown in the chart below.

The “mega-funds” within the venture capital world have become more prevalent over the years due to the huge difference in returns of top venture capital funds compared to the rest of the field. Access to top companies in the early stages of growth paired with the resources to help those companies reach their financial potential creates the key to success in venture capital. The take-away: if you’re going to invest in this space, it’s prudent to have access to the big players.

Conclusion

Buyout funds and venture capital hold great opportunity for high returns for those with the means to endure long holding periods and the risk of investing in underperforming or brand-new companies. While the private investing world is still small in comparison with the public markets, as the private equity market matures, the big players with the most resources to capital and deal flow tend to settle out on the top. Both venture capital and buyout funds aim to achieve capital growth within your portfolio.

Next up in the series:

Our next article will break down the remaining asset classes within private investments including private real estate, private credit, and infrastructure. CLICK HERE to access the next blog in the series.

[1] Bain & Company 2020 Global Private Equity Report p.85

[2] CB Insights, December 2019

Denver Private Wealth Management is an independent fee-based financial planning practice with 80+ years of experience in the financial industry. DPWM customizes portfolios based on your financial goals and works closely with you, your tax advisors and estate attorneys to form a comprehensive view of your financial situation. For more information or to set up a free consultation, contact us at info@denverpwm.com.

Post Disclaimer

The information contained in this post is for general information purposes only. The information is provided by The Alluring & Risky World of Private Equity: Exploring Buyout Funds & Venture Capital and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

Tim Kulick, CPA®

Tim Kulick, CPA®

Drew Kelleher, CFP®

Drew Kelleher, CFP®

Trackbacks/Pingbacks